In this comprehensive blog post, we'll delve into the often-overlooked but highly beneficial concept of Military Service Credit Deposits (MSCD), more commonly referred to as “Military Buy Back” or “Military Buy Back Time”. We'll cover what it is, who's eligible, the actual 5 step process with example calculations, and the advantages & disadvantages of opting for a Military Service Credit Deposit. By the end of this article, you'll be further equipped with the knowledge you need to make informed decisions about your valuable federal retirement benefits.

What Is a Military Service Credit Deposit (MSCD)?

A Military Buy Back is a unique opportunity for federal employees to credit their prior military service time toward their federal retirement benefits. This process has a rich historical background, dating back to the inception of the federal retirement system. It was introduced to recognize the valuable service of individuals who transitioned from military careers to civilian federal employment. MSCD allows federal employees to honor their past commitments, whether in active duty or reserve service, by counting those years toward their retirement benefits. This not only pays tribute to their dedication but also significantly enhances their retirement prospects, providing a well-deserved financial reward for their sacrifice and service.

Who's Eligible for a Military Buy Back Time?

The eligibility components of Military Buy Back are a vital aspect to consider, as not all federal employees qualify for MSCD; 3 specific criteria must be met to take advantage of this valuable opportunity.

To be eligible for an MSCD, you must meet the following criteria:

- Federal Employment Under FERS or CSRS: First and foremost, you must be currently employed in a civilian position under either the Federal Employees Retirement System (FERS) or the Civil Service Retirement System (CSRS). MSCD is tailored to provide additional benefits to those dedicated to a federal career after their military service.

- Prior Military Service: The heart of MSCD eligibility lies in your military history. You should have proudly served in the military before embarking on your civilian federal career. Whether you were part of the active duty force or served in the reserve component, your valuable service can be credited towards your federal retirement.

- Honorable Discharge: Another crucial condition is that your military service must have concluded with an honorable discharge. This honors your commitment to your military service and opens the door to benefiting from your service years in your federal retirement calculations.

Understanding these eligibility criteria is the first step towards leveraging the advantages of MSCD. It's essential to have a clear understanding of your eligibility status, as it plays a pivotal role in your retirement planning journey and securing your financial future.

The Process of Military Service Credit Deposits (MSCD)

Now that we've explored the significance and eligibility criteria for Military Service Credit Deposits (MSCD), let's delve into the intricacies of how this process works. Understanding the step-by-step process of MSCD is crucial to ensure a smooth and well-documented Military Buy Back experience! Now, let’s get into the weeds…

STEP 1: You need to have a copy of your Honorable Discharge Form and your Form DD214 (Certificate of Release or Discharge from Active Duty). These will have the applicable information on them to get an accurate calculation of your deposit and to determine eligibility. If you don’t have access to these documents, you can make a request, using Form SF-180 (that can take awhile in itself, so make sure to leave plenty of time to go through this process)!

STEP 2: Ok, we’ve got our docs in hand, now what? You’ll need to complete Form RI 20-97 (Estimated Earnings During Military Service) and submit it, and your documents from Step 1, to the Defense Finance and Accounting Service for our applicable branch of service (FOUND HERE ON PAGE 2). Within 30-60 days you will receive a letter showing your deposit amount.

STEP 3: Make sure to go over the paperwork and confirm the calculations yourself! Confirm that all of your service time is included and the amount calculated for you is correct. Remember, people make mistakes, it’s on you to double check, so you don’t overpay or get shorted on time!

STEP 4: Now the paperwork is done, time to pay the piper! You have the option to make the deposit in a lump sum or through payroll deductions, over time. However these deposits must be made prior to you receiving your first pension payment, or else you lose the opportunity! Once your deposit is complete, you’re all set!

STEP 5: The last, and easiest step… once your deposit is complete, your hard earned years of military service will be counted in your federal retirement calculations, leading to a higher monthly pension payment!

Important Things to Know About Military Buy Back Time

- You MUST have at least 5 years of civilian federal service to be eligible for a pension. You cannot use military time to get you to this lower limit. Let’s look at a quick example:

Mary has 3 years of federal service and she’s 62. She also has 2 years of creditable military time. She CANNOT simply buy back the 2 years and be eligible for an immediate voluntary annuity under the “62 years of age with 5 years of service” eligibility rule.

She must continue to work for another 2 years and THEN she can buy back her military time in order to bring her 5 years of service to 7 total years of service.

- Only BASIC PAY counts in the calculation. It does not include flight pay, combat pay, allowances, etc. (this is to your advantage as the higher the calculation, the larger the deposit!).

- Like all good things in life, MSCD comes at a cost. You'll need to pay a deposit, which is a percentage of your military base pay, plus interest in some cases. This can be a substantial sum, so you should carefully assess the financial implications to make sure buying back your military time makes sense for you.

So, What is the FERS Military Buy Back Calculation?

It’s important to note that the following calculation is applicable ONLY to FERS employees. If you’re CSRS, there’s different rules and percentages and you should speak directly with one of our advisors to figure out the calculation. Ok, so disclaimers aside, here’s the basic calculation….

Total Military Basic Pay x 3%* = Deposit Amount (PLUS INTEREST if applicable)

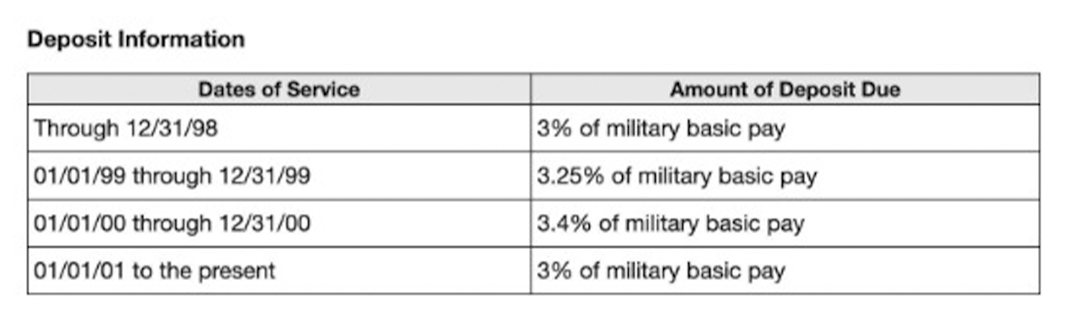

*3% in most cases, however it’s higher if you served in 1999-2000 (Why? Because your good Uncle Sam said so!). SEE CHART BELOW

So, as you can see, the calculation is quite straightforward, however it’s the calculation of interest that gets a bit trickier. But fear not, for most of you, it’s a matter of collecting the right paperwork and mailing them to the right department for calculation. However, for those curious, math loving types, let's look at a hypothetical scenario:

John is a federal employee under the FERS system who served in the military for four years from Jan 1, 1995 - Dec 31, 1998 (nice clean date breaks for ease of calculation). His military base pay for the 4 years were as follows…

1995 = $30,000,

1996 = $32,500

1997 = $32,500

1998 = $36,000

… his total military basic pay is $131,000 (simply adding up the years of basic pay). So, according to our simple formula above (Total Military Basic Pay x 3%), we get the following…

$131,000 x 3% = $3,930.00

Ok, pretty simple, John’s Military Buy Back deposit would be $3,930 for 4 years of service. But wait, let’s not forget about that pesky interest.

The interest is variable throughout time and determined annually by the US Treasury Department, so we won’t get too deep into that here, but let’s for example purposes say the interest rate was 6.25% for all the years John served, so the interest calculation would be as follows…

$3,930.00 x 6.25% = $245.63

Bringing our total deposit plus interest to…

$3930.00 + $245.63 = $4175.63

So, by making an MSCD deposit of about $4176, John would credit those four years toward his federal retirement. This will result in a higher annuity, which is especially beneficial in the long run.

Is Military Buy Back Time Worth The Investment?

Well, like most things with Federal Retirement, it depends. I would say in MOST cases it does, but let’s again look at John’s situation (from the example above) and see what his “Break Even” point would be…

By making the $4176 deposit, John will add 4 years of service to his pension calculation. Let’s make some assumptions…

- John’s “High-3” was $85,000

- His years of service (including buy back) are 22

- John is 60 years old

Based on the above assumptions, John will get 1% of his “High-3” for every year of service. So the additional 4 years he bought back will yield a 4% higher annual pension. Let’s look at the math…

$85,000 x 4% = $3,400

So for that $4176 deposit, John will receive $3400 more every year, FOR THE REST OF HIS LIFE. That means in less than 2 years (about 1 year and 3 months), the initial investment he made into his deposit will be recouped and he’ll be ahead from that point forward. There is no financial product in this world that pays those types of returns, that’s where I would put my money!

Empowering Your Retirement with Military Buy Back: A Personalized Approach

In this specific scenario, John's case demonstrates the significant advantages of making a Military Service Credit Deposit (MSCD). However, it's essential to remember that MSCD's benefits and costs can vary widely due to numerous factors. While MSCD often makes sense, it's equally vital to recognize that each federal employee's situation is unique. Variables like military pay, years of service, and future retirement goals can greatly impact the decision.

Military Service Credit Deposits (MSCD) hold the potential to be a game-changer for your federal retirement benefits. By grasping the process, associated costs, and potential advantages, you can better evaluate whether it aligns with your specific circumstances. Yet, navigating the intricacies of MSCD can be complex.

For tailored guidance and a comprehensive understanding of how MSCD fits into your retirement plan, consider consulting with experts like FERA. We specialize in helping federal employees maximize their retirement benefits and ensure a more secure financial future. Seize the opportunity to enhance your retirement benefits – take action today!

Related Posts

Postal Service Health Benefits Program (PSHB): Looming Changes in Health Coverage For USPS Employee in 2025

Attention all USPS employees, once more, it's time to delve into a noteworthy transformation that…

The FERS Annuity Supplement: 7 Essential Benefits for Your Retirement Success

Annuity Supplement Retirement planning is a journey that federal employees under the Federal Employee Retirement…

Federal Employee Retirement: Debunking Common Myths and Misconceptions

Planning for retirement is a crucial step in ensuring a secure financial future, especially for…

Retirement Repayment Options: Paying Back Unused Annual Leave and Sick Leave

Planning for retirement involves various financial considerations, including how to make the most of your…